[ad_1]

Coinbase’s The legal chief of the US Securities Exchange told CNBC on Friday that arguments in its legal case against the US Securities and Exchange Commission have been strengthened after a major court ruling went in favor of cryptocurrency firm Ripple.

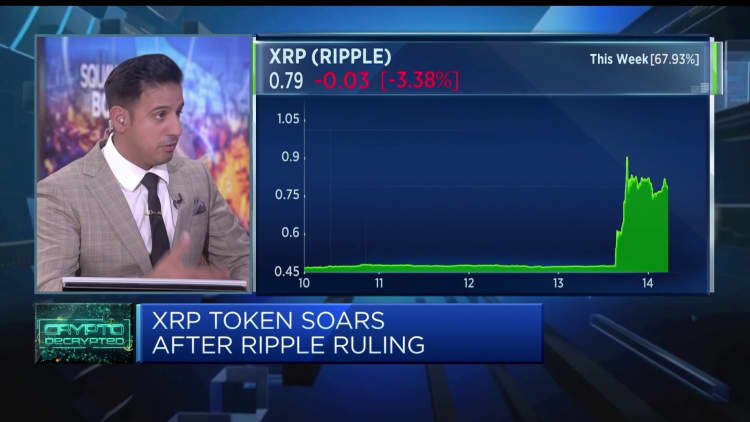

On Thursday, a US judge ruled that XRP token purchases via exchanges are not securities transactions. The Securities and Exchange Commission (SEC) sued Ripple, the company behind XRP, in 2020, alleging that the company violated securities laws.

Related investment news

The ruling was welcomed by the cryptocurrency community and especially by the exchanges, who felt the result would help create more regulatory clarity.

Among these exchanges is Coinbase, which was sued in June by the Securities and Exchange Commission for allegedly operating an unregistered exchange and broker.

But the latest XRP The court’s opinion gave Coinbase confidence in its case against the SEC.

“For exchanges, for tokens listed on exchanges, for ordinary investors, there is no doubt that this ruling deals a blow to the idea that somehow securities are traded when people go to exchanges and trade assets,” said Paul Grewal, chief legal officer. On Coinbase, to CNBC in a TV interview on Friday.

“I think we will win. Now I think we will win before this decision. We think this decision only strengthened the case,” he added.

Part of Coinbase’s optimism stems from the decision that XRP is not a security. If XRP is not classified as such, there is hope that hundreds of other cryptocurrencies will not be subject to security laws.

“I think it would be wrong to assume that, in every case and in every transaction, the securities laws don’t apply. This has never been Coinbase’s position, I don’t think it should be anyone’s reasonable position. But if you literally replace the letters XRP with the letters of any symbol Else, in this decision, reasoning still applies.”

However, another part of the ruling deemed it a securities transaction to sell XRP specifically to sophisticated investors or institutional clients.

Coinbase is trying to develop its own institutional trading platform. Grewal ignored this part of the case, as it relates to exactly how Ripple sells XRP to institutional clients.

“I think all investors, both institutional and individual, can take great comfort from the fact that when it comes to trading on the stock exchange, where there is trading on commercial lines, the court has made it clear that these tokens are not traded as securities,” Grewal said.

SEC blasted

Whether or not crypto assets are securities is an important question with several implications. If they are considered securities, they will need to register with the Securities and Exchange Commission and will have strict disclosure requirements. It would also give the SEC authority to supervise these assets and related companies, such as cryptocurrency exchanges.

The SEC has confirmed that most cryptocurrencies are securities — but the decision on XRP seems to weaken its argument.

It was the crypto industry heated words to the SEC over the past month, accusing the agency of regulating by imposing, not by working with the industry.

Buffalo Jonchar | Light Rocket | Getty Images

Tyler Winklevoss, co-founder of cryptocurrency exchange Gemini who is also under suit from the SEC, named The organizer is a “failed enterprise”.

Coinbase’s Grewal said he did not believe the SEC was waging an ideological battle against the cryptocurrency industry, but that all actions were done in “good faith.” But, he added, “They were wrong.”

“What I believe has been a failure of leadership to pursue reasonable engagement with the industry and with other stakeholders, rather than going to court,” Grewal said, calling for “new rules for dealing with new technology.”

[ad_2]