[ad_1]

In this photo illustration, a visual representation of Cryptocurrency Ripple is shown on January 30, 2018 in Paris, France.

Chesnot | Getty Images

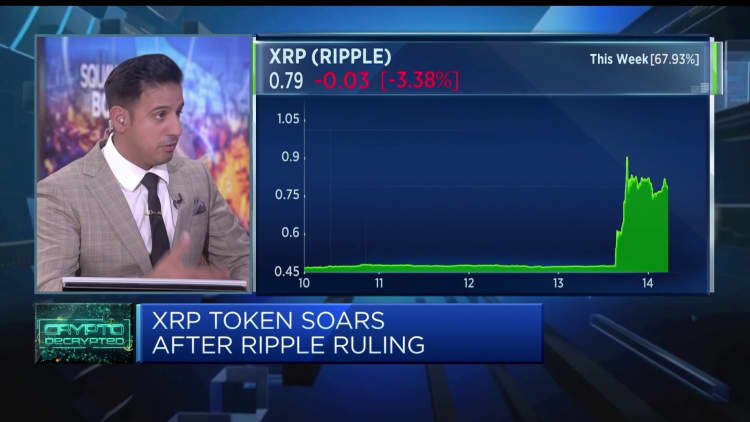

Blockchain startup Ripple is confident that US banks and other financial institutions in the country will start showing interest in adopting it. XRP cryptocurrency in cross-border payments after a landmark ruling decided that a token was not, in and of itself, necessarily a security.

The San Francisco-based company expects to start talks with US financial firms about using its on-demand liquidity (ODL) product, which uses XRP to transfer funds, in the third quarter, Stu Aldrotti, general counsel for Ripple, told CNBC in an interview. . last week.

Related investment news

Last week, a New York judge issued a final ruling in favor of Ripple holding that XRP itself “is not necessarily a security at face value,” in part dissenting from the SEC’s claims against the company.

Ripple has been battling the SEC for the past three years over allegations from the agency that Ripple and two of its executives illegally bid $1.3 billion through XRP sales. Ripple disputed the claims, insisting that XRP cannot be considered a security and is more of a commodity.

As a result, Ripple’s business has suffered, with the company losing at least one customer and investor. MoneyGram, the American money transfer giant, It relinquished its partnership with Ripple in March 2021.

Meanwhile, Tetragon, a UK investor that previously backed Ripple, sold its stake back to Ripple after unsuccessfully trying to sue the company for its money back.

Asked if the ruling meant US banks would revert to Ripple for using the ODL product, Alderotti said: “I think the answer to that is yes.”

Ripple also uses blockchain in its interbank messaging business, like the blockchain-based alternative to Swift.

“I think we hope that this decision will give clients of financial institutions or potential clients the comfort to at least come in and start having a conversation about the problems that they’re having in their business, real-world problems in terms of moving value across borders without incurring outrageous fees,” Al Deruti told CNBC on Friday. .

“Hopefully this quarter will lead to a lot of conversations in the US with customers, and hopefully some of those conversations will turn into real business,” he added.

Ripple now sources most of its business from outside the US, with Alderoty previously telling CNBC that “(Ripple) and its customers and revenue are all paid out of the US, although we still have a lot of employees inside the US,” he added.

Ripple has more than 750 employees globally, almost half of which are based in the United States

XRP is a cryptocurrency that Ripple uses to move funds across borders. It is currently the fifth largest traded cryptocurrency, with a market capitalization of $37.8 billion.

The company uses the token as a “bridge” currency between transfers from one fiat currency to another — say, US dollars to Mexican pesos — to solve the problem of needing pre-funded accounts on the other end of the transfer to wait for money to be processed.

Ripple says that XRP can enable fund movements in a split second.

However, the ruling did not represent a complete win for Ripple. While the judge stated that XRP was not a security, they also said that some of the token sales were considered securities transactions.

For example, Judge said that about $728.9 million in XRP sales to institutions the company worked with qualified as securities, citing the presence of a joint venture, and the expectation of profit.

Alderoty acknowledged that it wasn’t a complete win for Ripple, and that the company will study the decision in due course to see how it affects its business.

“(Justice Annalisa Torres) found – although we did not agree with her – that our immediately prior sales to institutional buyers had the characteristics of securities and should have been recorded,” he said.

He said Ripple’s business as it stands would not be affected by this element of the ruling because its customers are primarily located outside the United States

“We’ll look at the judge’s decision, we’ll look at our clients’ needs to look at the market, see if there’s a situation here that aligns with the four corners of what the judge found when it comes to institutions,” he said.

[ad_2]