[ad_1]

Pharmaceutical company Pharmizer said an oral drug to treat COVID-19 could be available by the end of 2021.

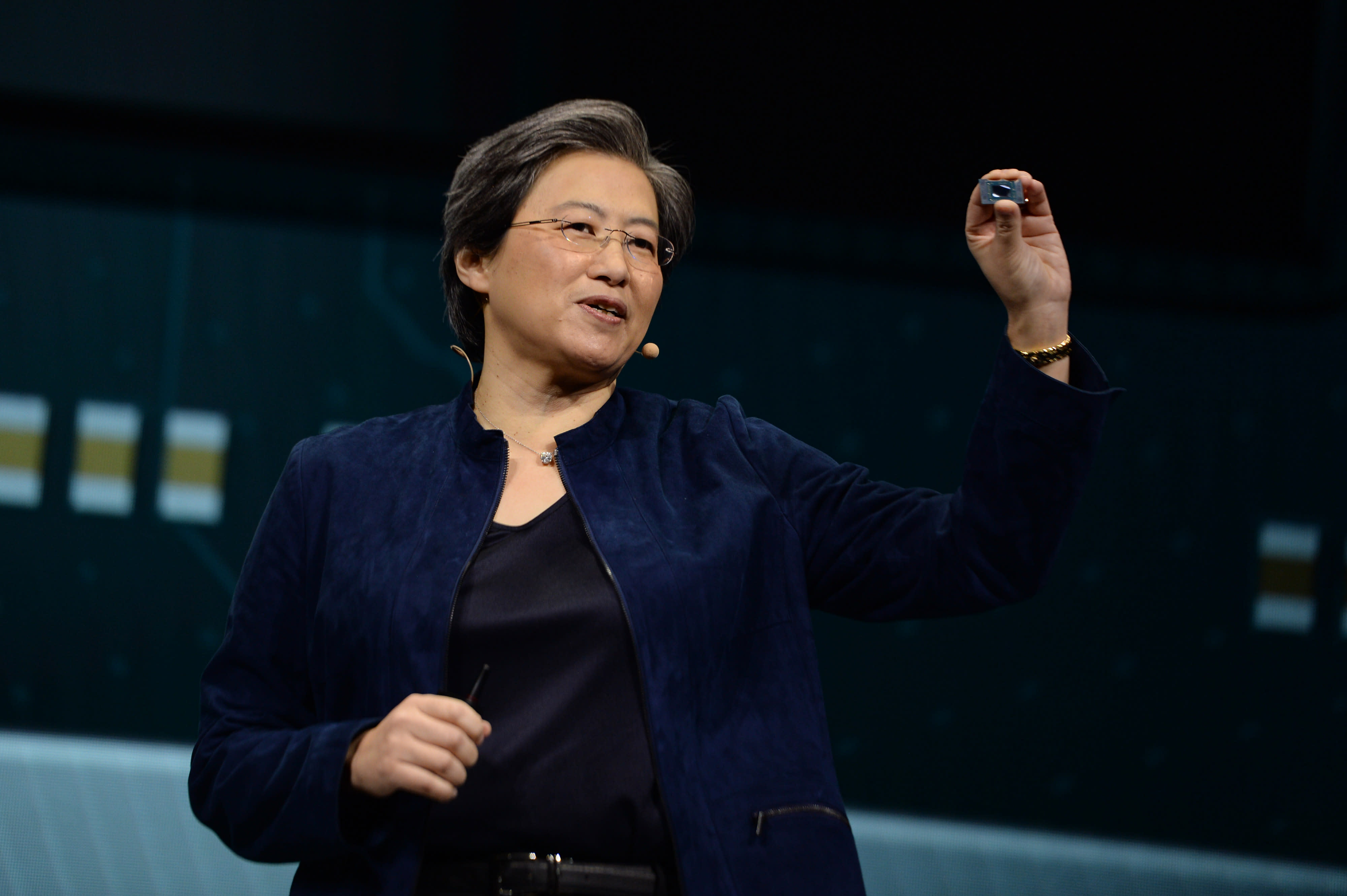

Soumyabrata Roy | Norphoto | Getty Images

Pfizer Tuesday mentioned First-quarter revenue and adjusted earnings beat Wall Street expectations, though lower sales were driven by lower demand for the company’s Covid vaccine.

The pharmaceutical giant’s stock closed slightly lower on Tuesday, at $39.06. Shares are down more than 23% year-to-date to Tuesday’s close, which puts the company’s market capitalization at about $220.47 billion.

Related investment news

Here’s what Pfizer reported compared to Wall Street’s expectations, based on a survey of analysts conducted by Refinitiv:

- Earnings per share: $1.23 adjusted to 98 cents expected

- he won: 18.28 billion dollars, compared to the expected 16.59 billion dollars

Pfizer’s net income of $5.54 billion, or 97 cents per share, was down from $7.86 billion, or $1.37 per share, during the year-ago quarter.

The company reported first-quarter sales of $18.28 billion, down 29% from the same period last year.

Covid-related sales contributed $7.1 billion to that number. Pfizer took in $3 million in revenue from its Covid vaccine and $4 million in sales of the antiviral Covid pill Paxlovid.

Looking ahead, the New York-based company maintained its 2023 sales forecast of $67 billion to $71 billion. Pfizer also reiterated its full-year adjusted earnings forecast of $3.25 to $3.45 per share.

But Pfizer continues to expect lower Covid-related sales this year. The company reaffirmed its forecast for Covid vaccine sales of $13.5 billion in 2023 and revenue of $8 billion for Paxlovid.

Pfizer CEO Albert Bourla said during the earnings call that the company expects 2023 to be a “transition year” for Covid sales, as it will be the US hubs for the commercial market for Covid products.

Covid Vaccine, Paxlovid Sales

Quarterly sales of the company’s Covid vaccine fell by $10 billion, or 75%, compared to the same period a year earlier, in what Pfizer said was primarily driven by lower contract deliveries and lower demand in international markets.

The company said deliveries contracted with the US government have slowed as the nation prepares to move Covid products to the commercial market later this year.

Paxlovid sales increased $2.8 billion year-over-year amid new launches in some international markets and strong demand in China due to a surge in Covid cases. Sales were also driven by final deliveries linked to the United States a contract It was completed in late December.

Paxlovid first entered the US market under an emergency use authorization in late December 2021. Pfizer hopes to win full FDA approval for the drug this year, but still expects 2023 sales to be down 58% from the previous year.

Bourla said Pfizer expects to increase uptake of paxlofide after this year.

“We then expect that in 2024 and beyond, courses sold and used will align closely,” he said.

Bourla said the company also expects US uptake of the Covid vaccine to slow this year and in 2024.

But the CEO noted that Pfizer expects vaccination rates to rebound starting in 2025 and “continuing into 2026 and beyond,” assuming the company successfully launches several combination Covid vaccine therapies.

Bourla said the company expects a similar trend outside the United States, with some differences in some countries.

Other medicinal products

Excluding sales of Covid products, Pfizer said first-quarter revenue grew 5% compared to the same period last year.

This growth was supported by products from recently acquired companies, including migraine drug Nurtec ODT from Biohaven Pharmaceutical and sickle cell disease treatment Oxbryta from Global Blood Therapeutics, which contributed $167 million and $71 million, respectively. .

The company said the increase was also driven by strong sales of drugs such as Sulperazone, an antibiotic to treat urinary tract infections, and blood-thinning drug Eliquis.

Pfizer also said it expects revenue growth of between 7% and 9% this year, excluding sales of Covid products.

Bourla said this is because the majority of the company’s near-term products are expected to be launched in the second half of this year. He indicated that the company expects to launch 19 vaccines and treatments over the next 18 months.

“As such, we expect our non-Covid revenue to grow at a faster rate in the second half of the year than in the first half,” Bourla said during the call.

Pfizer and other pharmaceutical companies such as accident And Johnson & Johnson He was bracing for a sharp decline in Covid-related sales this year as the world emerges from the pandemic and relies less on blockbuster vaccines and treatments for the virus.

But Pfizer is pinning its hopes on mergers and acquisitions and a record pipeline to help the company weather its post-pandemic boom.

That pipeline includes Pfizer’s RSV vaccine for use in the elderly, which may win FDA approval later this month. It also includes a new pediatric pneumococcal vaccine and ulcerative colitis treatment from recently acquired Arena Pharmaceuticals.

Pfizer also said last year that it plans to add $25 billion in revenue through deals by 2030.

In March, the company took a big step toward that goal with the $43 billion acquisition of Seagen, which it said could contribute more than $10 billion in risk-adjusted sales by 2030 through cancer treatments, according to Pfizer.

Read the earnings release.

[ad_2]