[ad_1]

Members of the Amazing Writers Guild of America (WGA) march in a picket line in front of the Netflix offices as SAG-AFTRA announced it had agreed to a “last-minute request” by the Motion Picture and Television Producers Alliance for federal mediation, but declined to extend its existing contract again after the date. Final negotiation on Wednesday at 11:59 p.m., in Los Angeles, Calif., July 12, 2023.

Mike Blake | Reuters

Traditional TV is dying. Advertising revenue is weak. Broadcasting is not profitable. And Hollywood has been virtually shut down as the writers and actors’ unions settle into what is shaping up to be a long and bitter hiatus.

All of this turbulence will be on investors’ minds as the media industry kicks off its earnings season this week Netflix up first Wednesday.

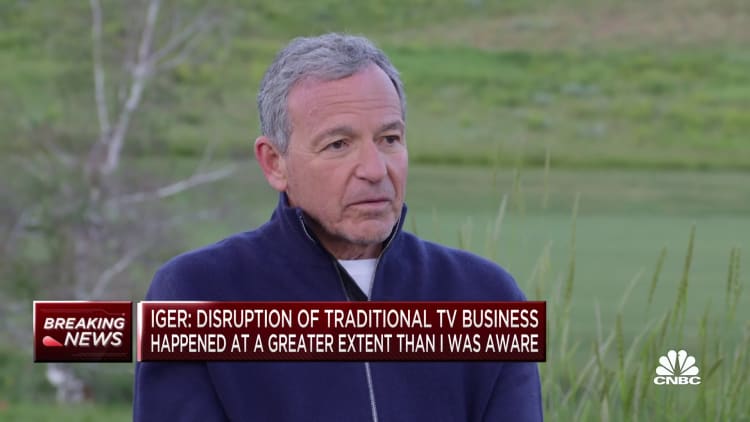

Netflix, with a new advertising model and a push to stop sharing passwords, looks in the best position compared to the old media giants. last week, for example, Disney CEO Bob Iger has extended his contract through 2026, telling the market that he needs more time at the Mouse House to meet the challenges facing it. At the top of the list are competing Disney TV networks, as this part of the business appears to be in worse shape than Iger could have imagined. “It may not be the essence of Disney,” he said.

“I think Bob Iger’s comments were a warning about the quarter. I think they’re very concerning for the sector,” analyst Michael Nathanson of SVB Moffett-Nathanson said following Ager’s interview with CNBC’s David Faber on Thursday.

Although the soft advertising market has been weighing on the industry for some quarters now, the recent entry of a cheaper ad-supported option for services like Netflix And Disney+ will likely be a bright spot as one of the few areas of growth and focus this quarter, Nathanson said.

Iger spoke at length on recent investor calls and an interview Thursday about how the announcement is part of a plan to bring Disney+ to profitability. Others, including Netflix, echoed the sentiment.

Netflix will report earnings after the close on Wednesday. Wall Street will be keen to hear more details about the launch of the password sharing campaign in the US and the status of its newly launched ad-supported option. The company’s stock is up nearly 50% this year, after a correction in 2022 that followed its first loss of subscribers in a decade.

Investors’ focus will also be on legacy media companies such as Paramount GlobalAnd Comcast Corp. And Discovery Warner Brothers, which each own large portfolios of pay-TV networks, following Iger’s comments that traditional TV “may not be core” to the company and that all options, including a sale, were on the table. These companies and Disney will report earnings in the coming weeks.

the scourge of the strike

A scene from “Squid Game” by Netflix

Source: Netflix

Just a week before the earnings start, members of the Screen Actors Guild – American Federation of Television and Radio Artists Join more than 11,000 film and television writers already on strike on the picket line.

The strike—as a result of failed negotiations with the Motion Picture and Television Producers Alliance—brought the industry to an immediate halt. It is the first such double strike since 1960.

Labor strife erupted just as the industry turned away from the influx of growth at all costs. Media companies saw a surge in subscribers — and stock prices — early in the pandemic, as they invested billions in new content. But growth has stagnated since then, leading to budget cuts and layoffs.

“The strike that has taken place indicates that this sector is going through massive disruption,” said Mark Boydman, head of investment banking, media and entertainment at Solomon Partners. He noted that shareholders, especially hedge funds and institutional investors, are “very disappointed” with the media companies.

Iger told CNBC last week that the downtime couldn’t have happened at a worse time, noting the “disruptive forces in this business and all the challenges we face,” and furthermore that the industry is still recovering from the pandemic.

These are the first strikes of its kind during the era of broadcasting. The last writers’ strike took place in 2007 and 2008, lasting about 14 weeks and leading to the emergence of unscripted reality television. Hollywood writers have already been on strike since early May this year.

Depending on the length of the strike, new film and TV content could dry up and leave streaming platforms and TV networks — other than library content, live sports and news — bare.

Insider Intelligence analyst Ross Bennis said the strikes may have less of an impact on Netflix, at least in the near term. Content produced outside the US is not affected by the strike – an area in which Netflix has invested heavily.

“Netflix is preparing better shows than most because they’re doing shows so early on. And if push starts, they can count on international shows, of which they have a lot,” Bennis said. “Netflix is the opponent in the eyes of the strikes because it changed the economics of what writers charge.”

The doom of traditional television

The decline in pay TV subscribers, which has been escalating in recent quarters, should also lead Continue to speed up As consumers are increasingly turning to streaming.

Yet despite the rampant downturn, many networks are still cash cows, and they also provide content for other parts of the business — particularly streaming.

For pay-TV distributors, raising the prices of cable packages was a way to stay profitable. But, according to another a report From MoffettNathanson, “Subscribers are dropping too quickly for prices to continue to compensate.”

Iger, who began his career in network television, told CNBC last week that while he already had a “very pessimistic” view of traditional TV before returning in November, he has since found it to be worse than he expected. Executive Disney said it is assessing its network portfolio, which includes ABC and cable channels such as FX, which suggests a sale may be on the table.

Paramount is currently considering selling a majority stake in its cable television network, BET. In recent years, Comcast affiliate NBCUniversal has shut down networks like NBC Sports and merged sports programming on other channels like USA Network.

“Networking is a dwindling business, and Wall Street doesn’t like a dwindling business,” Nathanson said. “But for some companies, there’s no way around it.”

To make matters worse, the weak advertising market has been a source of pain, especially for traditional television. It’s weighed on the earnings of Paramount and Warner Bros. Discovery in recent quarters, each of which has a slew of cable networks.

Ad pricing growth, which has long offset audience declines, is a key concern, according to a recent MoffettNathanson report. The company noted that this could be the first non-recession year in which advance advertising does not drive up TV prices, especially as ad-supported streaming hits the market and drives up inventory.

Streamers’ introduction of cheaper ad-supported tiers will be a hot topic again this quarter, especially after Netflix and Disney+ announced their platforms late last year.

“The soft advertising market affects everyone, but I don’t think Netflix is affected in the same way as TV companies or other broadcasters,” Bennis said. He noted that although Netflix is the most popular streaming software, its advertising level is new and has a lot of room for growth.

Advertising is now an important mechanism in the platforms broader efforts to reach profitability.

“It’s no coincidence that Netflix has suddenly become wise to standalone users while pushing a cheaper tier that contains ads,” Bennis said, referring to Netflix’s crackdown on password-sharing. “This is very common in the industry. Hulu’s ad plan gets more revenue per user than the ad-free plan.”

Will more mergers come?

Although the FTC has appealed the ruling, bankers see it as a win-win for deal-making during a slow period for mega deals.

“It was a nice win for the bankers to come into the boardroom and say we’re not in an environment where really attractive M&A gets shot down by regulators. It’s encouraging,” said Boydman of Solomon Partners.

Boydman added that at a time when media giants are struggling and shareholder frustration is growing, the judge’s ruling could lead to more deals because “a lot of these CEOs are on the defensive.”

Outside of the Microsoft deal, regulatory hurdles were prevalent. A federal judge closed the proposed purchase of Penguin Random House bookstore to Paramount’s Simon & Schuster last year. Broadcasting station owner Tegna canceled its sale to Standard General this year due to regulatory opposition.

“The fact that we are so focused on the Activision-Microsoft deal is indicative of the fact that dealmaking will be a tremendous tool going forward to enhance market position and elevate your company inorganically in ways that you simply cannot do on your own,” he said. Jason Anderson, CEO of Quire, a small investment bank.

These CEOs are not going to make a deal to make a deal. From this point on, it will require a higher bar to hold.

Peter Liguori

Former CEO of Tribune Media

Anderson pointed out that bankers are always thinking about a regulatory rollback, however, that shouldn’t necessarily be the reason why deals don’t hold together.

Warner Bros. merged. and Discovery in 2022, swelling the combined company’s portfolio of cable networks and combining its broadcast platforms. The company recently relaunched its flagship service as Max, integrating content from Discovery+ and HBO Max. Amazon He bought MGM that same year.

Other huge deals happened before that, too. Comcast acquired Britain’s Sky in 2018. The following year, Disney paid $71 billion for Fox Corp.’s entertainment assets — which gave Disney “The Simpsons” and a controlling stake in Hulu, but make up a small part of its TV holdings.

“The Simpsons”: Homer and Marge

Getty/Fox

said Peter Liguori, former CEO of Tribune Media and a board member of TV measurement company VideoAmp.

He said consolidation is likely to continue once companies finish working through these past mergers and get past the ongoing effects of the pandemic, such as increased spending to gain subscribers. “These CEOs are not just going to make a deal to make a deal. From this point on, it’s going to take a higher level of consolidation.”

However, with the rise of streaming and its lack of profitability and pay-TV customers hemorrhaging, more consolidation could be on the way, no matter what.

Whether mergers and acquisitions help move these companies forward is another matter.

“My reaction to Activision-Microsoft’s decision was that there would be more mergers and acquisitions if the FTC were to break up,” Nathanson said. “But the reality is that Netflix built their business on licensing content and not having to buy an asset. I’m not really sure if the big deals to buy the studios work.”

– CNBC’s Alex Sherman contributed to this article.

Disclosure: Comcast owns NBCUniversal, the parent company of CNBC.

[ad_2]