[ad_1]

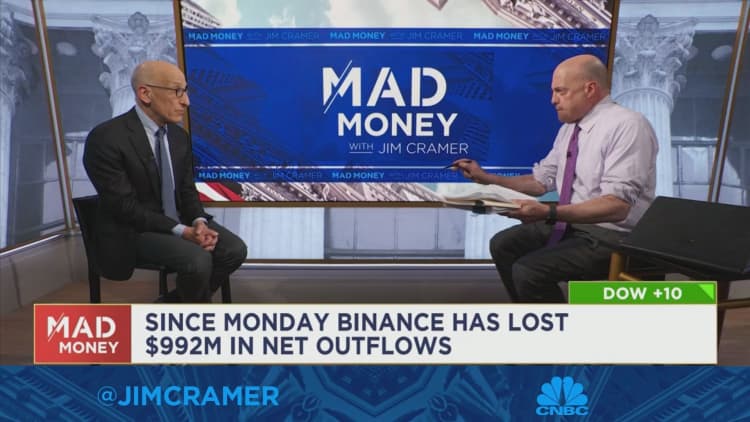

Binance co-founder and CEO Changpeng Zhao has given several interviews discussing the outlook for cryptocurrencies after a tumultuous two weeks in the market.

NurPhoto / Contributor / Getty Images

Federal regulators said in a statement Tuesday night that the $2.2 billion in US client assets held by Binance are at “high risk” of being stolen by founder Changpeng Zhao unless a freeze order is placed. and exchange committee.

Attorneys for the Securities and Exchange Commission filed an emergency motion earlier, citing A risk of capital flight and requiring the judge to return and freeze the assets of US clients to prevent illicit transfers by Zhao or Binance entities. The Securities and Exchange Commission (SEC) filed a lawsuit against Binance and Zhao on Monday, alleging they engaged in unregistered offering and selling of securities and mixing investor funds with their own funds.

Related investment news

The latest lawsuit described Zhao as “a foreign national who has publicly expressed his views that he is not subject to the jurisdiction of this court.” SEC lawyers alleged that two of Binance’s US subsidiaries – BAM Trading and BAM Management – were controlled by Zhao and had in fact generated at least $420.4 million in profit and fundraising for the projects.

Years of communication between the SEC and Binance, which does not claim an official seat, indicates that Binance.US has been unable to clearly indicate who controls clients’ assets, according to the filing.

The SEC alleged that “Zhao and Binance enjoy free control” over “customer assets worth billions of dollars.”

Zhao’s lawyers said the billionaire is not subject to US law, despite his control or beneficial ownership of US companies and bank accounts that sent billions of dollars to holding companies based in Switzerland and Britain.

The SEC says federal law and precedent establish court jurisdiction over Zhao and Binance.

“There is no question that the court has personal jurisdiction over all of the defendants,” the SEC said.

While Binance’s US arm has said it retains control of much of its technology and financial infrastructure, the SEC says Zhao’s eventual control puts investors’ assets at risk unless action is taken immediately.

“Given Zhao and Binance’s history of explicit desire to avoid US regulation and oversight, and their covert control over BAM trading and the mixing and movements of BAM Trading assets across a network of Zhao-controlled entities outside the US, there can be no guarantee that BAM Trading employees are not affected by Zhao or Binance today.”

Federal regulators are also asking the court to allow them to service Chow by emailing his attorney, saying his “geographical dodgy pattern” makes it difficult to determine exactly where he lives or is located. Zhao is said to be based in the United Arab Emirates.

Binance did not immediately respond to a request for comment.

He watches: Timothy Massad: Cryptocurrency Risks ‘It’s Not Just About Tokens’

[ad_2]